TL;DR

- Candidate sourcing channels are how you find and attract talent

- The right recruitment channels improve quality, speed and cost

- Use varied sourcing channels like online, offline, paid, free and referrals

- Match channels to each role’s level and skill needs

- Track cost, conversion and quality to refine what works

Every day, recruiters are buried under a sea of resumes. Many are unfit, some are duplicates and a few truly match what the company needs. With so many choices such as job boards, social media, agencies and referrals, how do you know which path will actually lead you to solid candidates? If you pick the wrong channel, you waste time, energy and money chasing candidates who never respond or drop off.

In this blog, you’ll learn how to choose the right candidate sourcing channels for each role. You will learn what these channels are, why the choice matters, different types you can use, how to match them to roles and how to measure which ones truly deliver.

What Are Candidate Sourcing Channels?

Candidate sourcing channels (or candidate sources) are the various routes or platforms you use to attract and identify potential job candidates. Think of each channel as a road your prospects might travel to find your job post or hear about your company. These include:

- Job boards (general or niche)

- Professional networks and social media

- Employee referrals

- Recruitment agencies and candidate sourcing companies

- Talent databases or internal talent pools

- Offline events like job fairs or campus visits

When you combine several, you compose your recruitment channels or talent sourcing platforms mix.

Each channel brings in different kinds of candidates. Some are active job seekers, others are passive but that mix matters. The art is in selecting which roads are best for a given position so your recruitment funnel doesn’t leak.

Channel Decoder — What Are Candidate Sourcing Channels?

Tap or press Enter on a card to reveal the meaning.

Why Choosing the Right Channels Matters

Choosing indiscriminately leads to low ROI. Many recruiters spend budget and hours advertising on every available candidate sourcing platform then see few conversions. A few reasons this matters:

- Cost efficiency: Some channels cost a lot (paid job ads, agencies). You want to pay more only where returns justify it.

- Quality over quantity: It’s tempting to chase volume but the best hires often come from targeted outreach. For example, an outbound, sourced candidate is reportedly 5x more likely to be hired than an inbound applicant.

- Speed: A good channel can dramatically cut the time to hire.

- Role fit: What works for a junior role won’t always work for C-level or niche technical roles.

- Scalability & sustainability: You want channels you can repeat and rely on.

Recent trends also support this focus. Over 67% of recruiters now use social media to recruit. So the right mix of candidate sources is not a random buffet. It’s a strategy.

Recruitment ROI Simulator — Why Choosing the Right Channels Matters

Distribute a $5,000 hiring budget across channels. The chart and KPIs update live.

Types of Candidate Sourcing Channels

Here’s a breakdown of different sourcing channels you can use. You’ll often blend several depending on your hiring goal.

Online/Digital Channels

- Job boards (general and niche): e.g. Indeed, Glassdoor, specialized tech or healthcare boards

- Social media/professional networks: LinkedIn, Twitter, Facebook groups, Instagram recruiting posts

- Talent databases/CV databases: platforms where recruiters search resumes

- Company careers pages/microsites: job posts on your own site

- Programmatic/paid ads: using ad networks or boosting to promote job posts

These fall under online sourcing and are often the first tools recruiters try. 57% of candidates use social media for job search and 92% of organizations use social platforms to source talent.

Referral/Internal Channels

- Employee referrals

- Alumni networks/boomerang hires

- Internal talent pools/past applicants

Referrals are powerful: referred candidates often integrate faster and stay longer.

Agency/Third-Party Channels

- Recruitment agencies/staffing firms

- Candidate sourcing services/outsourced sourcing teams

- Headhunters/executive search firms

These are useful when you need to scale fast or have hard-to-fill roles.

Offline/Real-World Channels

- Job fairs, campus recruiting events

- Networking events/meetups/industry conferences

- Print ads/local media (still relevant in some regions)

This is especially useful when targeting local or region-specific talent.

Proactive/Outbound Channels

- Direct outreach/cold outreach (email, InMail)

- Boolean search & sourcing on platforms

- Social recruiting/passive candidate tapping

This is where active vs passive sourcing strategies come in. Some roles require you to reach out to candidates who are not actively applying. Learning how to source passive candidates becomes essential here.

How to Match Channels to Roles

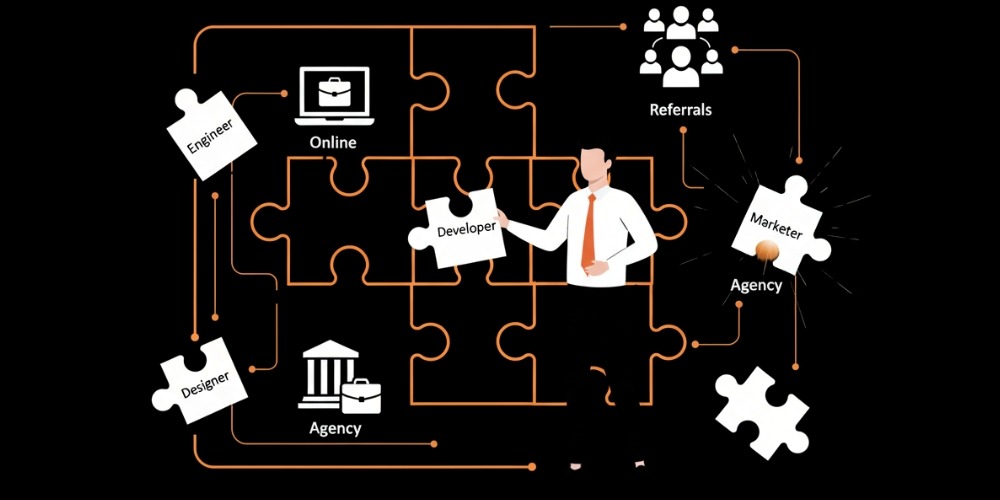

Choosing candidate sourcing channels at random won’t cut it. You must zero in on which recruitment channels best suit each role. Here’s how:

Profile your ideal candidate

Start by mapping your ideal candidate’s behavior:

- Are they actively job hunting (junior, non-specialized)?

- Or are they passive, meaning already employed, selective (senior, niche, technical)?

For active roles, mass candidate sourcing platforms like job boards and social media fare well. For passive ones, you lean on direct outreach, niche communities or talent sourcing platforms where passive talent congregates.

Role complexity and specialization

If you’re hiring for a role that demands rare skills (e.g. AI/ML engineers, cybersecurity), generic channels often underperform. You’ll need candidate sourcing services, candidate sourcing companies or specialized forums where such talent hangs out.

For more common roles (admin, general sales), broader recruitment channels like job boards, local ads or referral programs often yield better volume.

Budget, timeline and volume

- If your hiring timeline is tight, go where speed matters like boosted ads, agency sourcing or internal “fast lane” channels.

- If budget is tight, lean more on free candidate sources: referrals, alumni, internal pools, social media.

- If you have many similar roles to fill, you can afford to test and scale channels that repeat reliably.

Mix and test

Don’t rely on one channel. Use a mix: one high-volume channel, one niche channel, one referral or internal channel. Monitor all. Over time, drop underperformers and double down on what works for that type of role.

Stay flexible

A channel that works today for software engineers in Karachi might fail tomorrow. New platforms emerge, candidate habits shift. Regularly revalidate your mix.

Effective Candidate Sourcing Tips for Recruiters

Good sourcing starts with knowing where your best hires usually come from. Look back at your last ten successful hires and trace their paths. You’ll notice patterns like certain job boards, referrals, or social posts that consistently deliver. Focus your energy there instead of scattering efforts.

Build a rhythm of outreach. Message potential candidates weekly, not when roles open up. Keep your tone real and short. Skip generic lines like “We found your profile impressive.” Personalization beats volume every time.

Finally, track everything. Use your ATS or a spreadsheet to log source, time to respond, and outcome. Over a few cycles, you’ll spot your top-performing channels and the ones worth dropping.

Matchmaker Puzzle — How to Match Channels to Roles

Click a role and then click the channel you think fits best.

Roles

Channels

How to Measure Channel Effectiveness

You can’t know what’s working unless you measure. Here are the key metrics and how to use them:

Key Metrics to Track

Source of Hire (SoH)

Which channel produced your successful hires? If 40% of your hires came from referrals, that’s telling.

Sourcing Channel Effectiveness

How many candidates and hires came through each channel relative to inputs (costs, impressions)?

Sourcing Channel Cost/Cost per Hire

Total spend on a channel divided by how many hires it produced. For example, if you spend $1,000 on paid job postings and get 5 hires, that’s $200 per hire from that channel.

Time to Fill/Time to Hire

How long does it take a candidate from first contact to offer acceptance (or job acceptance)? Channels that shorten this time are more effective.

Quality of Hire & Retention Rates

It’s not enough to generate hires. You must see how well they perform and stay. If hires from Channel A perform worse than those from Channel B, that matters.

Conversion Rates

At each stage (views → applications → interviews → offers → acceptances), see which channels lose more candidates. That tells you where the leak is.

Setting up tracking

- Use your ATS (applicant tracking system) or CRM to label candidate entries by channel (e.g. “source = LinkedIn”, “source = referral”).

- Use analytics on your careers site to see referral traffic sources (Google Analytics, UTM tags).

- Monthly or quarterly, aggregate data: number of candidates from each channel, hires, cost, time, outcomes.

- Clean out noise: if a channel brings many low-quality candidates, that high volume may be misleading.

What to do with insights

- Drop or reduce spend on channels that cost a lot and yield little.

- Reinvest in channels with strong quality of hire, low cost or fast time to hire.

- Maintain a “testing channel” in each cycle to explore new sources (emerging candidate sourcing platforms, new social networks).

- Use benchmarking: compare your channel metrics against industry norms so you know whether to push harder or pivot.

Effective Candidate Sourcing for Better Talent Assessment

Strong sourcing fuels accurate talent assessment. The better your sources, the better your shortlist and the clearer your talent insights. When you bring candidates from focused, high-quality channels, your assessment tools can do their job without noise.

Pair structured sourcing with skill-based evaluation. For example, if you’re hiring data analysts, pull candidates from niche platforms like Kaggle or specialized LinkedIn groups. Then assess them through data challenges or project-based tasks.

By aligning sourcing with assessment, recruiters spend less time filtering and more time validating. The result is fewer mismatches, faster shortlists, and stronger hires backed by data, not guesswork.

Effective Candidate Screening with Vettio’s Tools

Vettio makes candidate screening simple, fast and fair. Its AI reads between the lines of resumes, highlighting skills and experiences that match your job requirements not just keywords.

You can filter applicants by performance indicators, engagement history, or even cultural compatibility. That means no more endless manual sorting or bias creeping in.

For teams scaling fast, Vettio’s automation keeps personalization intact. Candidates receive timely updates, while recruiters see analytics that reveal which sourcing channels bring the strongest fits. It’s candidate screening made smart, measurable, and human.

Conclusion

Choosing the right candidate sourcing channels is not about chasing every shiny platform. It’s about matching your role, budget and timeline to channels where your ideal candidates already spend time. Then, measure results rigorously and shift resources toward what works.

With the right mix, you reduce cost per hire, improve hire quality and build a sustainable pipeline. Keep testing, stay data-driven and iterate. That’s how you build sourcing that scales.