TL;DR

- Talent assessment in the finance industry helps you hire finance the right way.

- Hiring in finance is high-stakes due to regulation, risk and money handling.

- A clear skills-first hiring guide reduces costly mis-hires.

- Assessments uncover real abilities before you are ready to hire a candidate.

- Great assessments align with skill acquisition goals are based on clear job needs.

Today’s finance sector moves fast and small hiring mistakes cost big. When a firm fails to match candidates to the real demands of a role, turnover rises, productivity drops and compliance risks grow. In the finance sector, guessing who will succeed is no longer good enough.

That is why talent assessment in the finance industry is becoming the foundation of smarter recruiting. With the right evaluation, teams move beyond gut feelings to discover who is genuinely ready for hire and positioned to contribute from day one.

Why Hiring in Finance Requires Higher Precision

Roles in finance are not just about numbers. They involve judgment, risk management, ethical decision making, regulatory understanding and keeping client trust intact. For example, a poor hire in financial services can cost up to 30% of that employee’s first-year salary in lost productivity and recruitment expenses if they do not perform well.

Unlike many other sectors, a finance role often operates under scrutiny from regulators and clients. One small error in accounting, reporting or compliance can create cascading effects for a company.

One Wrong Hire Cost Simulator

Move the sliders. See how one bad finance hire can quietly turn into a very loud problem.

What Is Talent Assessment in Finance?

Talent assessment for finance refers to the structured evaluation of a candidate’s skills, traits and potential before they join a team. These assessments can range from financial reasoning tests and personality inventories to simulations of real-world tasks. The goal is to predict how well a person will perform once hired, reducing guesswork in hiring decisions.

Finance assessments go beyond resumes and interviews. They quantify core competencies such as analytical reasoning, ethical judgment and decision-making capacity. These tools help you bring in people who can do the work well and show the judgment and attitude expected in financial services.

Assessment Stack Builder

Drag cards into your stack. Build the assessment you would actually run.

Why Talent Assessment Is Critical in the Finance Industry

Assessments Drive Better Decisions

Finance leaders are relying more on structured tools to take uncertainty out of hiring. When everyone is measured by the same standards, personal bias has less room to slip in. This is especially important in competitive finance roles where strong interview skills do not always reflect real job performance. Consistent evaluation makes it easier to see who can actually handle the work once the role begins.

Align Hiring With Evolving Needs

Finance roles no longer look the way they did a few years ago. Data, digital systems and new regulatory tools now shape day to day work. Resumes and interviews alone often fail to show whether someone can handle these shifts. Well designed assessments help surface the practical skills that align with what the role actually requires.

Reduce Costly Mis-Hires

Poor hires are expensive. In sectors like finance, where regulatory compliance and client trust are paramount, a mismatch can result in customer loss, compliance penalties or reputational damage. Talent assessment mitigates these risks by ensuring candidates are suited for the complexity of their roles.

Support Skills-Based Hiring

Adopting a skills-first hiring guide helps companies evaluate what candidates can do, not just where they studied or worked. In the broader market, 87% of finance companies are now using skills-based hiring as part of their recruitment process. This is higher than the average across industries, highlighting how critical skills evaluation is in finance.

Better Candidate Fit and Retention

Assessments help spot people who match the skills and the way a team works. When the fit is right, then teams work better together and hiring mistakes happen less often.

Decision Fork Scenario

You are hiring a senior finance analyst under time pressure. Pick a path and see what happens over 3 months.

Key Skills Finance Employers Must Assess

Finance hiring is no longer about finding someone who is just good with numbers. Employers need people who can think clearly under pressure and act responsibly when the stakes are high.

One of the first abilities to look for is analytical thinking. Finance professionals need to read data, notice patterns and make choices that impact cash flow, investments and compliance. A good finance assessment focuses on how someone approaches a problem, not how quickly they reach a number.

Another key area is risk awareness. Risk is part of everyday finance work, so candidates need to show they understand trade offs, controls and long term impact. This is where assessments go beyond basic finance knowledge and look at real judgment in action.

Ethical judgment matters just as much. Finance teams work with private information and major financial decisions. When assessments present ethical conflicts then employers can see how a candidate responds when expectations, pressure and rules come into tension.

Clear communication is just as important. Finance professionals need to break down complex ideas for people without a finance background. When real world communication scenarios are tested then it becomes clear whether a candidate can turn understanding into clear action.

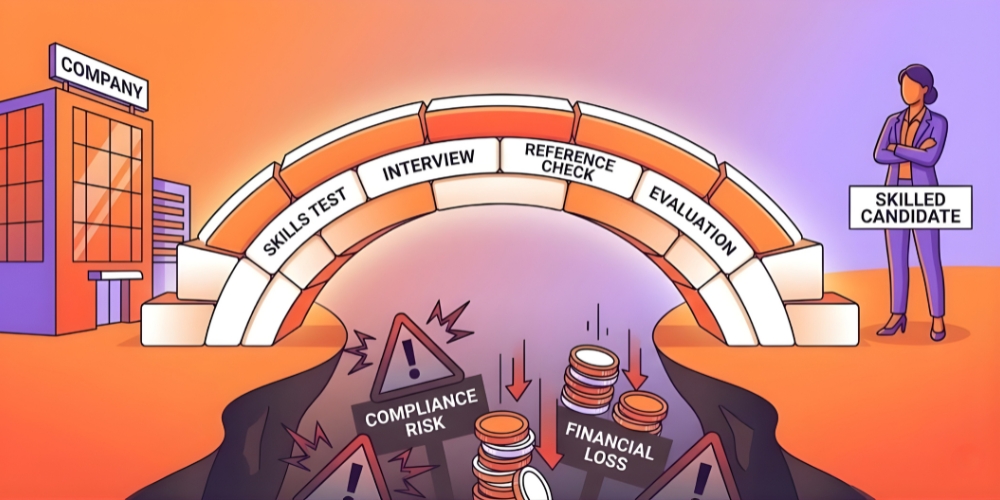

Common Hiring Mistakes in Finance

One of the most common mistakes is relying too heavily on resumes. A strong background does not always equal strong performance. Many employers still skip structured evaluations and assume past job titles tell the full story.

Problems start when hiring is rushed and no one stops to define what the role actually needs. In that rush, skill acquisition goals are based on urgency instead of real business demand. The gap does not feel obvious at first but it tends to appear months later when expectations are missed.

Some firms miss how much consistency really matters. When each interviewer follows their own path, hiring choices start to drift. Without a common point of reference, personal bias sneaks in and capable candidates can pass by unnoticed.

Lastly, many organizations fail to think about the candidate experience in talent assessment. Long or unclear hiring processes push good finance candidates away, especially in competitive markets.

Spot the Hiring Trap

Read the situation. Pick Safe or Trap. Then see what usually happens next.

How Talent Assessments Reduce Financial Hiring Risk

Reducing risk begins with knowing what to expect. When assessments follow a clear structure then hiring teams gain a better sense of how a candidate is likely to perform before they are officially hired.

Using talent assessment with recruiter software helps standardize evaluation across teams. Everyone measures candidates against the same criteria, which improves fairness and reduces errors caused by personal bias.

Assessments also protect against compliance risk. Testing regulatory understanding, data handling and ethical decision-making ensures new hires are aware of industry expectations.

When gaps are spotted early then employers can sidestep expensive rehiring efforts and lower the risk of regulatory trouble or damage to their reputation.

Risk Shield Mapping Tool

Toggle assessment layers on or off. Watch the shield strength change in real time.

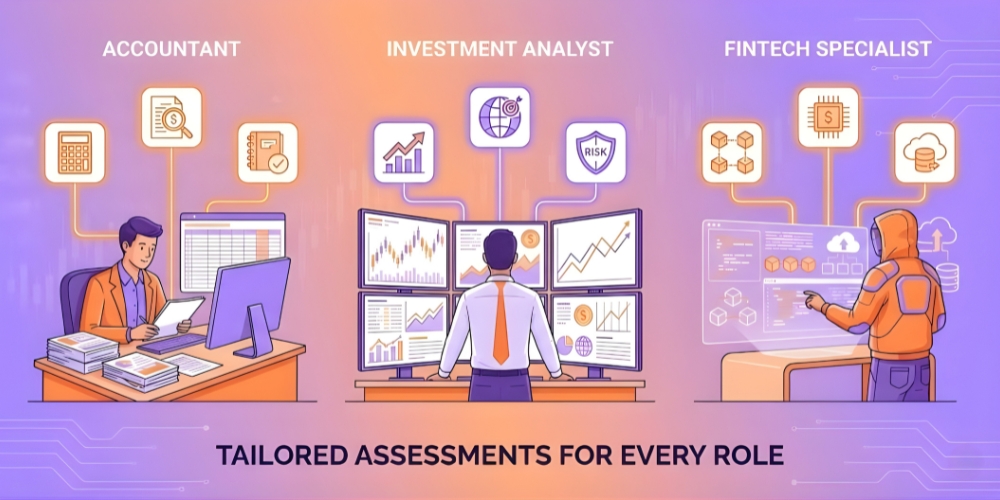

Role-Specific Talent Assessment in Finance

Not all finance roles require the same skills, which is why role-specific assessment matters.

For accounting roles, precision and compliance knowledge are key. Scenario-based testing shows how candidates handle audits and reporting deadlines.

In investment and banking roles, decision speed and risk judgment take priority. Simulated market scenarios help reveal how candidates think under pressure.

In fintech and financial analytics roles, comfort with digital tools and the ability to adapt are essential. Many companies now use AI tools for talent assessment to observe how candidates solve problems and learn in fast changing settings.

Organizations building future pipelines also rely on talent bank online assessment platforms. These tools help track high-potential candidates over time, ensuring teams can hire finance talent quickly when needs arise.

Role Match Diagnostic

Pick a finance role. Get the top skills to test, the risk most teams miss, and the assessment they forget.

Conclusion

Hiring in finance allows very little margin for mistakes. A bad choice affects more than payroll and can impact trust, compliance and long term stability.

By adopting structured assessments, finance employers move from guesswork to confidence. The right approach ensures teams hire people who are capable, ethical and truly prepared to contribute from day one.